New Evidence Points to Inner Solar System Origin of Theia

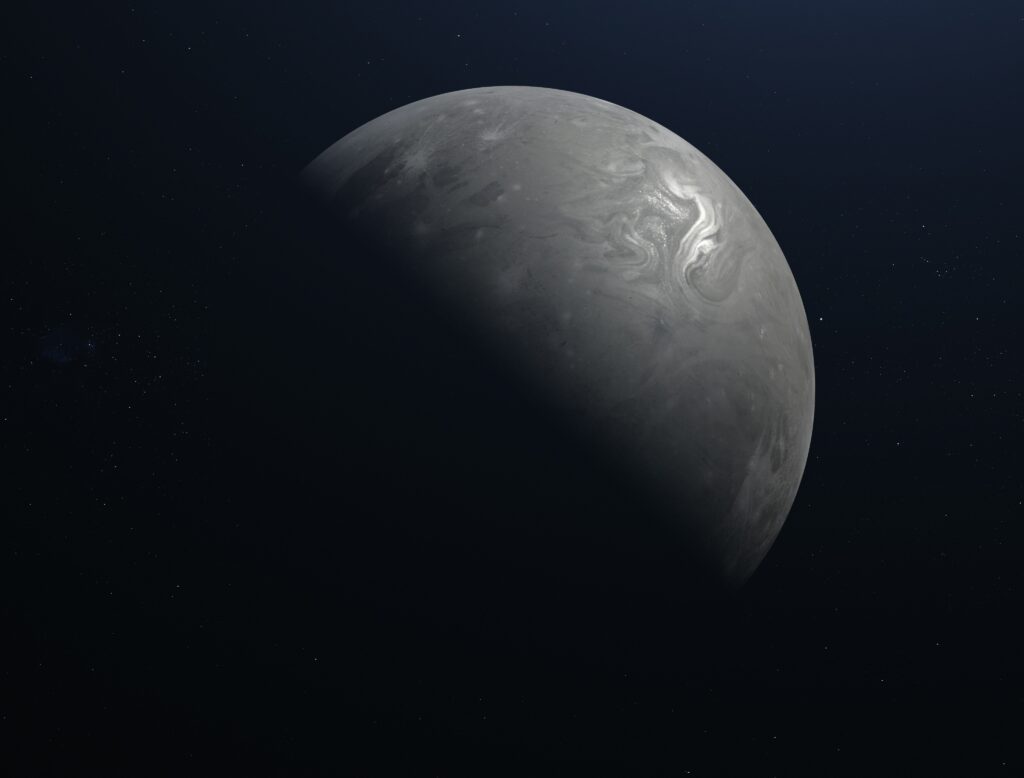

Recent research by an international team of astronomers from France, Germany, and the United States has reignited debate over the origins of Theia—the long-lost protoplanet believed to have collided with early Earth around 4.5 billion years ago, leading to the formation of the Moon. While direct physical evidence of Theia remains elusive, advanced isotopic analysis of lunar and terrestrial rock samples is now offering compelling clues about its birthplace. Contrary to earlier theories suggesting Theia formed in the outer Solar System, new data indicate it likely originated in the inner Solar System, within the same region as Earth, Mars, and Venus. This conclusion is drawn from high-precision measurements of oxygen, titanium, and tungsten isotopes preserved in ancient lunar basalts and Earth’s mantle rocks.

The isotopic similarity between Earth and Moon samples—long a puzzle in planetary science—has traditionally challenged the giant impact hypothesis. If Theia had formed far from Earth, its chemical composition should differ significantly. However, the latest modeling shows that if Theia accreted from material in the inner Solar System, its isotopic signature would closely match Earth’s, resolving this discrepancy. According to findings published in recent astrophysical journals, simulations incorporating dynamic accretion models suggest up to 70% of Theia’s building blocks may have shared a common reservoir with proto-Earth, supporting a co-genetic origin within 1–2 astronomical units (AU) from the Sun.

Isotopic Modeling Closes Gaps in Lunar Formation Theory

One of the most enduring challenges in lunar science has been the so-called “isotopic crisis”: the near-identical isotopic fingerprints of Earth and Moon rocks across multiple elements, including oxygen-18/oxygen-16, titanium-50/titanium-46, and tungsten-182. These similarities imply a high degree of mixing during the impact event or a shared origin of the colliding bodies. Earlier models struggled to explain how such thorough mixing could occur without violating angular momentum constraints.

The breakthrough came through refined hydrodynamic simulations combined with nucleosynthetic isotope modeling. Researchers used data from Apollo mission samples and modern terrestrial mantle xenoliths to reconstruct pre-impact conditions. Their results suggest that Theia was not a chemically exotic body but rather a sibling planetesimal formed under similar thermal and compositional conditions as Earth. This implies the Moon inherited much of its mantle material not just from Earth’s crustal debris, but also from Theia’s own iron-poor, silicate-rich mantle—altering assumptions about the distribution of valuable minerals in the lunar interior.

Implications for Lunar Mantle Composition and Resource Distribution

If Theia contributed significantly to the Moon’s mantle, then regions deep beneath the lunar surface—particularly in the Procellarum KREEP Terrane and South Pole–Aitken Basin—may harbor concentrations of incompatible elements delivered during the merger. KREEP (an acronym for potassium (K), rare earth elements (REE), and phosphorus (P)) is already known to be enriched in heat-producing elements like uranium and thorium. The revised model suggests these deposits may be more widespread than previously estimated due to large-scale mantle hybridization post-impact.

Furthermore, helium-3 (³He), a promising fuel for future fusion reactors, accumulates on the Moon via solar wind implantation. However, volcanic activity driven by internal heat sources—many linked to KREEP-rich zones—can trap and concentrate helium-3 in regolith layers. A Theia-originated mantle component rich in radioactive elements could mean enhanced geothermal gradients, prolonging volcanism and increasing the spatial extent of viable helium-3 extraction sites. Preliminary estimates suggest accessible helium-3 reserves could exceed 1.1 million metric tons in the top five meters of lunar soil, with current market equivalents valued at over $20 trillion if commercial fusion becomes viable by 2050.

Reassessing Space Mining ROI Under Updated Planetary Models

From an investment standpoint, the evolving understanding of lunar formation directly impacts long-term return on investment (ROI) projections for space mining ventures. Traditional financial models assumed a relatively homogeneous lunar crust derived mostly from post-impact reaccretion. However, the inclusion of Theia’s geochemical contribution introduces greater uncertainty—and opportunity—in resource forecasting.

- Lunar rare earth elements (REEs): Estimated total REE content in the Moon’s crust ranges from 50–100 parts per million (ppm), comparable to terrestrial concentrations. However, certain mare basalts show localized enrichments up to 200 ppm, particularly in neodymium and dysprosium—critical for electric vehicle motors and wind turbines.

- Water ice: Although not directly tied to Theia, polar ice deposits remain essential for in-situ resource utilization (ISRU). Recent NASA LCROSS and LRO missions confirm over 600 million metric tons of water ice in permanently shadowed craters—valued at approximately $1 billion per ton for life support and propellant production.

- Investment horizon: Most analysts project commercial viability of lunar mining no sooner than 2040, with initial capital outlays exceeding $50 billion collectively across public and private sectors.

Emerging Investment Vehicles in Off-World Resources

As scientific clarity improves, financial markets are responding with new instruments targeting space-based commodities. Several exchange-traded funds (ETFs) have launched with exposure to aerospace innovation and extraterrestrial resource development, including the Procure Space ETF (UFO) and the ARK Space Exploration & Innovation ETF (ARKX). These funds include companies involved in lunar lander development, robotics, and ISRU technologies.

In a notable move, one U.S.-based investment strategy firm recently added $50 million in Bitcoin holdings to its crypto portfolio, citing digital assets as a hedge against inflation and geopolitical instability during long-duration space projects. While cryptocurrencies do not directly fund mining operations, they represent a growing trend in alternative financing mechanisms for high-risk, high-reward frontier industries. Meanwhile, venture capital funding in space startups reached $8.5 billion in 2023, according to Space Capital’s Q4 report, with 30% allocated specifically to lunar infrastructure and resource extraction platforms.

Risks and Realities of Lunar Resource Finance

Despite growing enthusiasm, investors must remain cautious. Legal frameworks governing extraterrestrial resource ownership remain ambiguous under the Outer Space Treaty of 1967, which prohibits national appropriation but allows use of resources—a gray area still being negotiated internationally. Additionally, technological hurdles, launch costs, and operational latency pose significant risks. For example, even optimistic scenarios estimate a round-trip communication delay of 2.5 seconds between Earth and Moon, complicating remote operation of mining systems.

Moreover, economic viability depends heavily on advancements in fusion energy (for helium-3 demand) and sustainable in-space manufacturing. Without these catalysts, lunar mining may remain subsidy-dependent for decades. As such, allocations to space mining equities should be treated as speculative, long-term positions within diversified portfolios, ideally capped at 1–3% for retail investors.