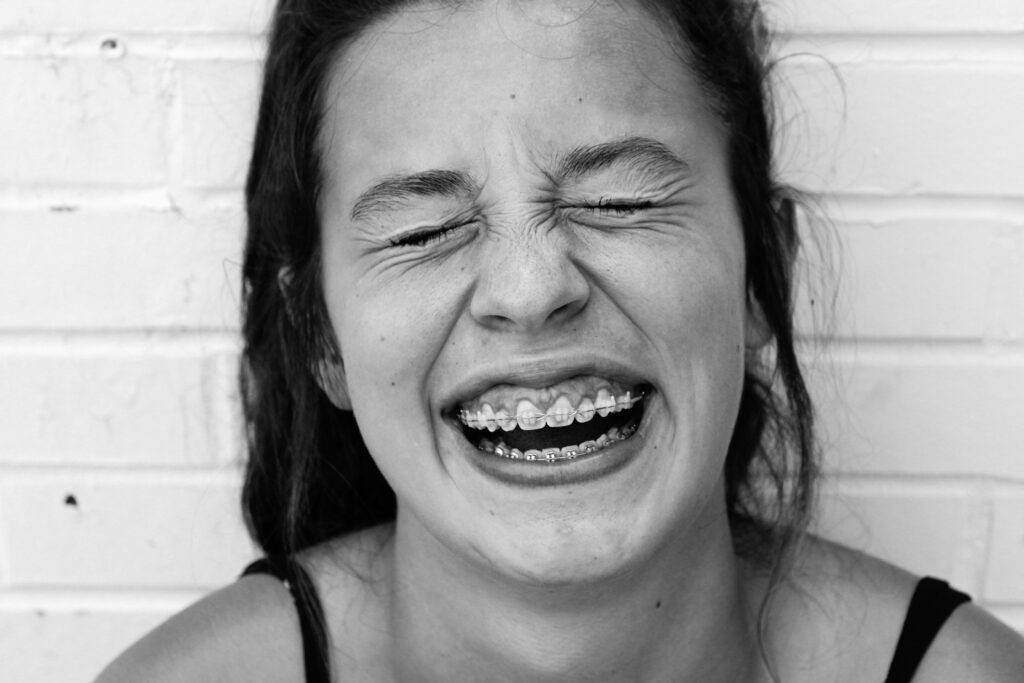

New Evidence Supports Nitrous Ooxide as Rapid-Acting Depression Therapy

A growing body of clinical evidence indicates that nitrous oxide (N2O), commonly known as laughing gas, may provide rapid and significant relief for patients suffering from treatment-resistant depression. A recent study published in leading psychiatric journals found that a single one-hour inhalation of 50% nitrous oxide led to measurable improvements in depressive symptoms within hours — effects that lasted up to two weeks in some participants. These findings are particularly notable because they suggest a non-opioid, non-ketamine option for fast-acting intervention in major depressive disorder (MDD), a condition affecting over 17 million adults annually in the U.S. alone.

Researchers at institutions including Washington University School of Medicine have been instrumental in advancing this work. Their trials demonstrated that N2O modulates glutamatergic signaling — the same brain pathway targeted by ketamine — but with a potentially more favorable safety profile and lower dissociative side effects. Now, the research team is preparing the first UK National Health Service (NHS)-backed clinical trial to evaluate the real-world safety, efficacy, and delivery logistics of nitrous oxide as a scalable depression treatment. If successful, this could pave the way for regulatory approval and integration into mainstream psychiatric care.

Limitations of Current Antidepressant Therapies

Despite decades of pharmaceutical development, conventional antidepressants such as SSRIs (selective serotonin reuptake inhibitors) and SNRIs (serotonin-norepinephrine reuptake inhibitors) remain inadequate for many patients. On average, it takes 4–6 weeks for these medications to produce noticeable symptom relief, and nearly 30% of patients do not respond adequately even after multiple treatment attempts. This lag time poses serious risks, especially for individuals experiencing suicidal ideation or acute depressive episodes where immediate intervention is critical.

The emergence of rapid-acting treatments like ketamine and its derivative esketamine (marketed as Spravato by Johnson & Johnson) has opened new doors, but access remains limited due to high costs, strict administration requirements, and potential for abuse. Moreover, ketamine can cause dissociation, dizziness, and elevated blood pressure, limiting its use in certain populations. There is a clear unmet medical need for fast-acting, well-tolerated, and cost-effective alternatives — a gap that nitrous oxide-based therapies may be poised to fill.

Potential Market Impact on Biotech and Medical Technology Sectors

If nitrous oxide gains traction as a validated depression treatment, it could catalyze investment interest across several segments of the healthcare and biotechnology industries. Companies involved in gas delivery systems, anesthesia technology, and CNS (central nervous system) drug formulation stand to benefit. Firms specializing in precision inhalation devices — such as those used in procedural sedation or respiratory therapeutics — may see increased demand for next-generation N2O delivery platforms tailored to outpatient psychiatric use.

While no single company currently dominates the ‘laughing gas depression treatment’ space, early movers could include medical gas suppliers like Linde plc (LIN) and Air Liquide (AI.PA), which already manufacture and distribute medical-grade nitrous oxide globally. Additionally, smaller biotech firms focused on neuropsychiatric innovation, such as Axsome Therapeutics (AXSM) — developers of investigational rapid-acting antidepressants — may explore partnerships or reformulation strategies leveraging N2O mechanisms. Device manufacturers like Medtronic (MDT) or GE HealthCare (GEHC), with expertise in anesthesia delivery systems, could also become strategic players if specialized N2O administration units enter clinical practice.

Investment Opportunities in Mental Health Biotech and Healthcare ETFs

For investors seeking exposure to the evolving landscape of mental health therapeutics, direct stock picks remain high-risk due to the early stage of nitrous oxide clinical development. However, diversified exposure through exchange-traded funds (ETFs) offers a more balanced approach. Consider the following ETFs with significant holdings in neuropharmaceutical and specialty healthcare companies:

- iShares Neuroscience and Healthcare ETF (NEURO): Focuses on companies engaged in brain health innovation, including CNS drug development and digital therapeutics.

- SPDR S&P Biotech ETF (XBI): Provides broad exposure to small- and mid-cap biotech firms, many of which are active in psychiatric drug research.

- ARK Genomic Revolution ETF (ARKG): Includes disruptive life science companies exploring novel treatment modalities, including neuromodulation and gene-based therapies.

These funds allow investors to participate in the broader trend toward innovative mental health solutions without over-concentrating in any single experimental therapy. As clinical validation progresses, fund managers may increase allocations to companies developing gas-based neuropsychiatric interventions.

Risks and Considerations for Investors

While promising, the path from pilot study to approved therapy is long and uncertain. Nitrous oxide faces regulatory, logistical, and perception-related hurdles. Though widely used in dentistry and obstetrics, its association with recreational misuse and environmental impact (as a potent greenhouse gas) may complicate public and policymaker acceptance. Furthermore, long-term safety data for repeated N2O administration in psychiatric settings remains limited, and questions about optimal dosing, frequency, and patient selection must be addressed in larger Phase III trials.

From an investment standpoint, there is currently no publicly traded company solely dedicated to nitrous oxide depression treatment. Any near-term stock movements related to this therapy would likely be speculative. Investors should exercise caution, avoid momentum-driven decisions, and focus on companies with strong clinical pipelines, regulatory track records, and sustainable business models. Diversification, thorough due diligence, and a long-term horizon remain essential when navigating emerging sectors in mental health biotech investments.