Posted inCentral Bank Policies (Fed, ECB)

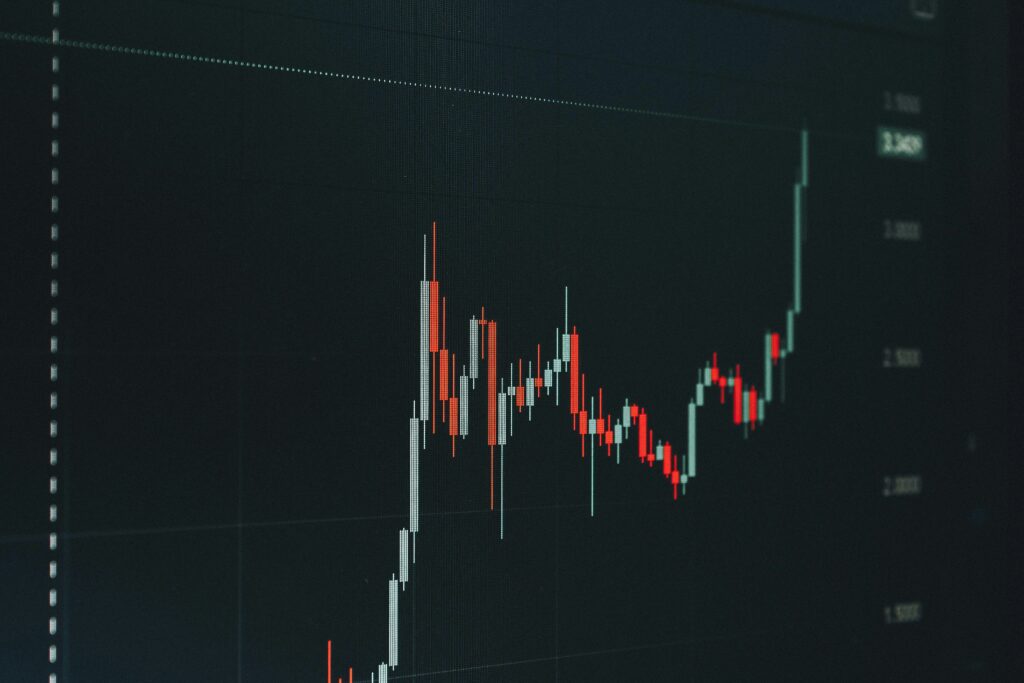

Federal Reserve Rate Cut Outlook in December: Inflation and Labor Market Risks Weigh on Dovish Hopes

As inflation remains above the Fed's 2% target and labor market indicators show mixed signals, the likelihood of a December rate cut is uncertain. This analysis examines key economic data, market expectations, and investment implications for bonds, equities, and the U.S. dollar.